Do Won Chang (Hangul: 장도원) is an American businessman of Korean descent. He is best known for founding the clothing retail store Forever 21.

Chang grew up in South Korea and moved to California at 18 in 1981. He and his wife, Jin Sook (Hangul: 진숙), opened a clothing store then named Fashion 21 in 1984 in Highland Park, Los Angeles. His store took off and as he expanded to other locations, the store's name was changed to its current title Forever 21. The number of stores grew to 457 by 2010.[1] The company has since remained a family operation. Forbes in 2011 estimated Chang and his wife's net worth to be $2.2 billion.

1 Comment

It will be interesting to watch Zillow's entry into China with the US housing market site translated into Chinese. There is the expectation of a flood of wealthy investors from China rushing into all US markets. This seems to be a spread across the globe of wealth control by the few. When the country was first founded only property owners could vote and everyone else was disenfranchised. Are we moving to a new kind of public disenfranchisement? With years of student debt upon graduation, diminished opportunity to own a home which represents financial stability, and no job security, are we passing on a future devoid of opportunity for the next generations? Families Blocked by Investors From Buying U.S. Homes By Kathleen M. Howley - Oct 24, 2013 7:10 AM PT The homeownership rate declined to 65 percent in the first half of this year from a peak of 69.2 percent in June 2004. The level is expected to stabilize at about 63 percent, adding more than 2 million households to the rental population, according to Morgan Stanley analyst Haendel St. Juste. Pendulum Swings Families are still able to live in single-family homes with a yard for their kids to play in, said Daren Blomquist, a RealtyTrac vice president. However, they’re sending their money to investor-landlords, rather than paying off a mortgage. “The pendulum is swinging too far from the direction we saw during the run-up to the mortgage crisis,” Blomquist said in an interview. “Then, we tried to make everyone an owner. Now, we have people who have the income to pay a mortgage and have the desire to own a home who are stuck being renters.” Read the article and view the video here This is compelling data that shows a clear direction for people to take to pursue viable global employment. What the slide deck fails to address is that projected lack of employment opportunities regardless of how trained and prepared you are. At the World Economics Forum in Davos, 2012, the then CEO of Citi Bank declared that by 2020 the world would be 400,000,000 jobs short (read here).

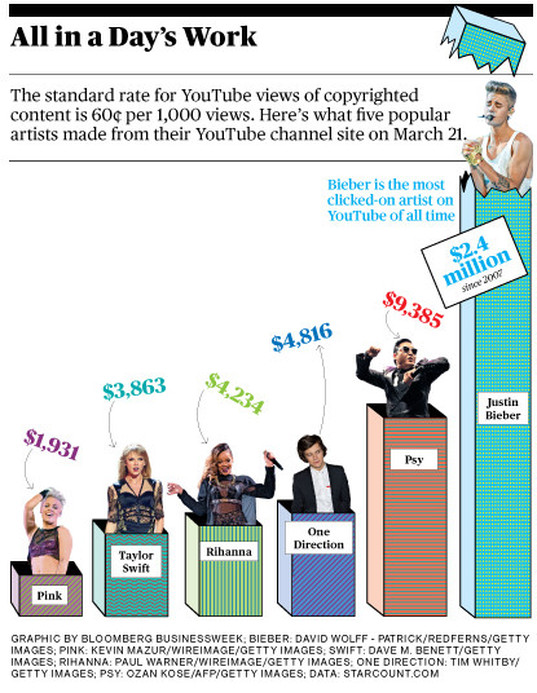

The bigger issue address is not required skills and training but who will have access to opportunity and where?  Anyone who thinks they should wait and see how things progress will be left behind in the dust of societal, economic, cultural, and political change. The job you will have tomorrow may be in an industry that is just being born today. The products, markets and companies of next month and next year may not have existed 6 years ago. Facebook opened its site to the general public just six years ago. This article is a great testimonial to the power of change driven by technology. Now in YouTube stars are born, serious money is made, and the global economy feels more and more like a neighborhood. A decade ago the record industry’s gears clicked along more or less as they always had: Labels signed up promising acts discovered by A&R scouts, paid those acts advances against future music sales, and hawked that music through a sprawling network of radio programmers and retailers. Today, with album sales continuing to plummet—in 2004, 666.7 million albums were sold; by 2012 that number was down more than 50 percent, to 316 million—labels and artists depend more than ever on touring and merchandise for revenue. Songs are ads meant to help sell tickets and T-shirts, and YouTube is beginning to rival radio when it comes to breaking those tracks. Recognizing this, the trade magazine Billboardrecently overhauled its formula for determining the most popular music in the country, giving YouTube plays more weight. The following week, Harlem Shake topped the Hot 100 chart—the first instrumental track to do so since Jan Hammer’s Miami Vice theme in 1984. Five weeks later, it was still there. Read more at Bloomberg BusinessWeek  Top 10 Tech-Influenced Hiring Trends for 2013 How Today’s Tech Trends Translate to Talent By Kathryn Ullrich 1. Renewed Focus on Innovation Now more than ever, rapid advancements in digital interconnectedness, big data and other technologies mean that tech companies need executives who can innovate and envision the next generation of users and devices. We’re seeing this even from leading tech industry clients who are already innovators but realize that innovation requires constant attention and reinvention. Execs who can see beyond today to visioning the future are in high demand. 2. Strategic Nimbleness Rules Working in Silicon Valley for early stage companies requires what I call "strategic nimbleness" – the ability to take a business model and adapt it to what the market is saying now. I’ve handled some VP Sales and General Manager searches recently where the company believes it understands the sales model and why customers are buying. But the company may need to strategically pivot a product and/or sales message based on the latest marketplace learnings. Entrepreneurial companies need executives who can strategically pinpoint new opportunities and then execute for results. 3. Emphasis on Selling Services I’ve long specialized in finding executives who can sell services for consulting company clients who place a premium on strong skills in this area. Most tech salespeople are experienced at selling products or software applications. But as more tech firms start offering high-margin information-based services, companies are seeking sales execs who know how to sell them. It's a different animal requiring hybrid skills of a consultant who has installed services and who can communicate their value to customers. Today’s most in-demand sales execs know how to sell both products and intangibles. 4. Analytics Acumen a Must Companies now have huge amounts of customer data available to help boost targeting and efficiency. That puts a premium on execs who truly understand analytics, and – more importantly – know how to use data-based findings to improve performance. Whether the field is general management, marketing or engineering, executives who learn how to harness data analytics will have a bigger role going forward. In my view, marketing – typically a non-tech function in the past – will become an increasingly technical role based on an explosion of marketing analytics. 5. Social Media Marketing Goes Next-Gen Marketing executives must keep pace with the changing digital landscape of web advertising, social media, SEO/SEM, and myriad of new owned, earned and paid marketing channels and techniques. One VP Marketing tells me she reserves budget specifically for advances she doesn’t yet know about. Companies are well beyond simply trying out Facebook, Twitter and other social platforms. Now it's about turning engagement into sales. The only sure thing is that social will keep evolving. 6. Enabling Technologies Hold Sway During the California gold rush, the suppliers – or enablers – made the most money. In similar fashion, various tools and technologies that support and amplify the Internet and social media will be the "pick axes" of our connected world. Executives understanding and producing these enabling technologies will continue to derive value rather than competing for the next generation of users. 7. Execs Embrace Gamification A half dozen years ago, one CMO candidate distinguished himself by finding innovative ways to market through cleverly imbedded games and product placements deep within targeted search results. Now we even see companies such as Salesforce adding gamification in the form of badges for increasing sales. With millions of casual gamers and a growing percentage of those paying for games, executives who understand gamification can find ways to increase revenue through this mechanism. Who knew countless hours of game-playing could pay off? 8. More Asia/America Leadership Connections With China’s explosive growth and Silicon Valley's already strong manufacturing relationships with Asia, I’m seeing a lot more inter-region hiring activity. Several multi-billion dollar Asian companies have engaged our firm to start or enhance Silicon Valley offices. And we’ve been hired to find Asian Americans to fill critical leadership roles in Asia for US-based firms that want US-style leadership skills infused into an Asian office. I’m already brushing up on my college Mandarin! 9. Resume Keywords Get Real Companies look for talent by searching for resume keywords such as cloud, SaaS, Big Data, mobile applications, etc. But some candidates go overboard with job titles saying, for example, "VP Sales Cloud Computing" in 2000 – long before the term cloud computing was ever used. I find it’s better when executives list the predecessor technology they worked on. My advice is to use “software defined” language such as client server, thin client, hosted software or others. It shows me – the recruiter – that you understand the underlying business models. 10. "Value-Based" Interviewing Takes Hold Interviewing can be subject to trends and has, itself, moved beyond behavioral and case interviewing. The trend now is toward probing the specific value a prospective candidate can bring to the company. What would the candidate do today? At the executive level, candidates should have a well-defined point of view on what skills and experiences they bring that can make a difference. Companies are asking candidates to present a 90-day business plan for the job. Candidates may weary of providing "free consulting" but that’s the new price of admission. Current Searches Kathryn Ullrich Associates' recent search work has included a VP Sales for a hosted software company, VP Sales Cloud Computing for a $35 billion technology company, Regional Sales Director Asia Pacific for an electronics distributor, and VP HR for an ecommerce company. We are currently working on the following searches:

For more information, visit www.ullrichassociates.com. Kathryn Ullrich Associates, Inc. focuses on C-level, VP and Director hires across the functions of Sales, Marketing, Product Management and Consulting for technology and services companies. News Kathryn Ullrich and Getting to the Top have been quoted extensively in the news this past year! Read details at http://www.gettingtothetop.com/MediaKit.aspx Follow us… Twitter at http://twitter.com/GettingtotheTop LinkedIn at http://www.linkedin.com/in/ullrich, and Facebook at http://www.facebook.com/gettingtothetop. More Information For more information on Kathryn Ullrich Associates, Inc. and our executive recruiting services, please call 650-458-8775, email [email protected] or visit www.ullrichassociates.com. It is interesting to note that drops in the equity markets and general economic crashes have generally occurred in the Fall. Even though the US economy has done a yeoman's job of pulling itself back from the abyss, it doesn't mean we won't be dragged over the cliff by the rest of the world. This certainly makes the tech sector the brightest star in the night heavens compared to other employment sectors. Consumer electronics is a cheap thrill compared to buying a new car. And tech devices and Cloud computing are productivity tools that impact the bottom line when growing revenues doesn't. We aren't out of this mess yet.  from the Globe and Mail article BRIAN MILNER The Globe and Mail Published Tuesday, Oct. 09 2012, 7:48 PM EDT Last updated Wednesday, Oct. 10 2012, 6:34 AM EDT The rest of the world is ratcheting up already intense pressure on Washington and Brussels to head off another global economic crisis, as the outlook grows ever dimmer. The gravest threats to the increasingly fragile recovery lie in a divided United States and a wounded euro zone, according to the growing chorus of voices that are urging governments to act quickly and decisively to deal with crippling debt and fiscal problems.  It is so addictive when surfing around the Internet to identify and click on interesting bits of information, articles, news stories with the little Pinterest Pin It button and post an image and link to one of my Pinterest boards. Pinterest is a visually, discriminating version of Delicious.com, and Stumbleupon. I pick out a relevant image on the article's page, tag it and attach a brief comment/opinion of my own. I use the image to attract your attention to the information and the article. I know that's not exactly what Pinterest intended but it works. Most people put up a collage of clothes, artwork, jewelry, photos, fashion, food, travel, movies and music images. You know, lifestyle. Just look at the Pinterest category list. There is no category for business, the economy, globalization, philosophy, history, politics, careers and jobs, or any of my board titles. Pinterest has self-created its own limitations because it focuses on the image as an end unto itself rather than the means, conduit and connection to an even greater end... the source of the image and attached link. I connected my Facebook profile to Pinterest so that all my pins post to FB. I have had, in just two days, several people comment and repin a number of pins. Now that is cool because nobody comments on my blog posts, except for the occasional spamer. Check out my Pinterest boards on Career Tools, Global Economy, Working Wisdom and Culture. You may get addicted too!  Despite four years since the global crash and 9+ since Linkedin was born, many executives and professionals haven't grasped the full impact of a reset economy and the Internet on a job hunt. Here are some the most common ill conceived notions that I hear: 1. Being on Linkedin will bring job opportunities to you. There is a common belief that if you build your profile, then the recruiters will flock to you. Well, most likely, your Linkedin profile will give you a boost on Google ranking in a name search. Solution: The big value of Linkedin is the access you get to networking in 50 groups and 50 subgroups. Rather than waiting to be found, build your Linkedin connections into thousands for ongoing leverage. 2. I customize my resume for every position and opening. Good luck with this one because they will all have to synch your one Linkedin profile. For that matter, all your profiles on Viadeo, Xing, Linkedin, Orkut, etc should all deliver the same message about you. Solution: Focus your search target on one or two overlapping business domains. Gear all your branding and positioning of yourself around those sectors. 3. The search firms don't get back to me or they have nothing for me. Search firms more than ever are working to find the perfect fit for their client companies. Given that their business is down by more than half since the crash, the demand of top talent continues to exceed supply. Unless you exactly fit their requirements, you will find no opportunities forthcoming from them. Solution: Using search consultants and headhunters as a source of information about market trends and companies hiring would provide more fruitful results. 4. My continued outreach to my network is wearing out my welcome with them. Don't use up your direct network by continuous asking for introductions to job openings. When those turn up empty, or as dead ends... and they mostly do... then your network is exhausted. Solution: Double or triple your network by using your existing connections for introductions into their network. This grows a relevant source of contacts in your field without much effort. 5. My employer will suspect that I am looking if I am highly visible on the Internet. I am still surprised by how much that concerns people when millions are on social networks now. Just do an advanced people search on Linkedin by your company and competitors. You will find more than you expect. Solution: Get on the Internet with gusto because you only have to do it once. Put up profiles. Build a website and blog. Become visibly well branded and be done with it. Once you are on it, that becomes old news. 6. Since I am not willing to relocate, I am looking only at local employers. The market place for talent is now global and your competition can come from anywhere thanks in part to the Internet and to the willingness of professionals outside the USA to seek opportunities anywhere. Solution: Search globally and work locally. You cannot determine who or where your next employer will be. You can negotiate the details like location when they make an offer. 7. I don't need to be visible online as my job is secure and I am happy in my current situation. Nowadays all marketing is online. Look at every Superbowl ad for its references to product websites. Professional advancement, and career promotion are done equally outside your organization as within. Solution: The professional status you build for yourself outside your company reflects positively on you and your organization. Making a name for yourself is most easily done online.  The Labor Market Bites Chinese Factories As retention of factory workers becomes a problem for companies in China, wages and benefits are increasing. But employers still face a labor shortage -- and their potential responses to it may have big implications for China and the rest of the world. By Peter Cappelli the George W. Taylor Professor of Management and director of the Center for Human Resources at The Wharton School. Read entire article This fascinating article reiterates some of the themes I have blogged about concerning the global economy. The free market for wages and labor has finally arrived in China. Coming back from Spring Festival, workers are delaying their return to shop around among factories for the highest salary and best perks. Foxconn, Apple's i-everything manufacturer, has announced wage increases that bring the Chinese factory worker on par with their counterparts in Mexico. This is coming faster than I expected in terms of a rising tide raising all boats (countries) closer to wage parity. And this will eventually budge the USA off the salary sandbar where wages have been moored for more than a decade of steady declines. Cappelli expresses hope that this turn of events will help usher in modern management practices into China such as employee retention. Wow! I never thought that I would mention that and China in the same sentence. This all bodes well for long term technology manufacturing coming back to the USA with the rising wages and costs of fuel driving that return. Steve Jobs was wrong on that one. On the other hand, there is a glut of new college grads without employment opportunities as they lack experience and training. They might be potential converts over to factory jobs according to Cappelli. However the increasing number of college grads in China will apply more competitive pressure to that same demographic sector here in the USA. Once again, this is another action call to new grads in the USA to gain internship experience, add to their portfolio of marketable skills, learn languages and build a career sustainable network to launch them well. Companies in the USA, especially the big dogs, the global multinationals need to develop immediate contingency plans to secure ongoing stable cost of goods produced including labor costs. Short-term Vietnam, other Asian nations, or Latin America will provide those options. However, long-term might look like North Dakota next to that tar sands oil pipeline. Fuel and supply chain costs to deliver to markets and cost of labor will be the deal makers or breakers in the next 5 years.  FB move from Palo Alto to Menlo Park Here is an excerpt from an article about Facebook moving to Menlo Park and the hardship to the city: "On the other hand, Sun used to generate annual sales taxes of $431,000 to $827,000 for the city. That's because the state levies taxes on physical goods like computers that it doesn't levy on virtual services like online ad sales. Having more employees on the campus means the city is going to have to expand services to accommodate them, such as hiring more police officers or clerks. And while new high-income Facebook employees moving into the area might send property assessments soaring, Proposition 13 will limit the amount of additional property taxes." Read Chris O'Brian's story in the San Jose Mercury News You want Facebook to move to your city right? Think of all the job creation and tax revenues! The City of Menlo Park has mixed emotions about Facebook bringing its entire workforce into one mega campus formerly occupied by Sun Microsystems. Yes, there will be some upfront fees and revenues collected with the move-in but the long term liability is increased demand on city services with little increase in ongoing sustainable tax revenues. What is Menlo Park doing? Why asking Facebook for a handout to subsidize low-income housing in one of the most expensive cities in the Bay Area. Facebook is more than obliging. It is truly being a good citizen and why not? It certainly is getting off virtually scott-free compared to actually paying taxes. The issue is one of unequal and unfair burdens of taxation on different types of industries and sectors in the California economy. This is an antiquated tax code that does not respond to the realities of a new economy and the Bay Area's economic base moving from computer and semi-conductor products to the Internet. The State of California is fighting to get Amazon to charge sales tax to residents of the state. But compare that tax income, to the revenues that could be generated by the virtual services of local Internet companies. Facebook is a $500,000,000 company (I put all the zeros in to make a visual point). Why are they, and Linkedin, Groupon, Yelp, Zynga, and others not paying tax on their virtual revenues as Sun did on their computers and Apple does now on its iPhone, iPad and iPod? The law needs to change and now. How ridiculous that a city is reduced to begging for a handout from a company. Let Facebook hire its own fire department, police force, street maintenance workers.  I have been working with top executives worldwide as well as in Silicon Valley for a number of years now. They are primarily employees of the big multinational European and American companies. Some are Americans, most are not, and many were educated in the USA at a top business school. The vast majority of them are not company "lifers" in that they haven't been with the same company for years, but have job hopped from company to company and country to country. A Silicon Valley executive called me the other day thinking he needed to make a job move. His company (a top Fortune 500 software provider) was insisting that he take a promotion and 4 year transfer with his family to China. With a Chinese wife and his two small children becoming bi-lingual, this would have been a good experience for the family. He is in finance and the role would have been at the country level running all operations. It was a plum assignment. With Asian experience, he would be able to attract the best global opportunities from other corporations after this assignments. It took much refection and research before he convinced himself to take the opportunity and see it as such.  The World Economic Forum ended on a dark worried note about the future of the worldwide workforce. The Davos gathering didn't doubt the numbers or projections. It is the means to the end that gave them consternation. According to Vikram Pandit, CEO of the global bank, Citigroup Inc., "The world needs 400 million new jobs between now and the end of the decade, not counting the 200 million needed just to get back to full employment, so "that should be our number one priority". It is not a simple scenario to just materialize 600 million jobs in 8 years. It is a real and dire problem with the nothing less than the world economy at stake. The financial leaders and heads of corporations spent time finger pointing across national boundaries, but they came away without a tangible solution how to grow worldwide GDP and therefore jobs. That there is no concerted and coordinated global response to a looming work crisis may indicate a fundamental problem with how our worldwide economic system functions with implications that impact all class and economic levels. We Aren't Entitled to Work? Is there such a thing as a right to work in a free market, capitalistic, global economic system? Are we as a population in the USA entitled to earn a living if we are sound of mind, able bodied and skilled? It was easy to ignore this issue when unemployment numbers were composed of the poor, uneducated and unskilled. However since 1980, every recession has generated unemployment creep upwards from manufacturing, to white collar, to now the executive suite. This has resulted in a substantial ongoing dislocation of the socioeconomic structure of the US population . Today the 12+ million "officially" out of work is about the size of Illinois and that fails to account for the underemployed and those not looking. At the same time, the employment agency, Manpower, reports that 75% of its revenues are now from outside the USA. In America, we know where the jobs have gone and continue to go-- elsewhere. But that begs the question as there still won't be enough work to go around worldwide with an emerging, educated, skilled, global middle class. Are we entitled to earn a working living at the expense of another somewhere in the world? Doesn't everyone deserve the opportunity to make a contribution and be paid for doing it? The essence of work is contribution. You do a day's labor and are paid a living wage. But what if there is not enough work to go around anymore? Does that mean that those that want to work and can't find it are facing life as an underclass of people who are going without the basic necessities of survival, and are deprived of being contributing members of society? Will work, especially highly skilled, intellectual work, become an entitlement or privilege? Wherever you are in the world, you got your job because of a set of advantages. Call it luck, fate, geography, position, status, connections, or price-point. The others who missed out on the opportunity didn't quite have your unique set of advantages but they were just as smart, talented, hard-working, earnest and yet unemployed.  Private Equity firms own companies that employ 1 in 10 employees in the USA making them the nation's largest employer. They own across all sectors including Harrahs, Hostess, Clear Channel, Energy Future Holding Company, AMC Movies. How did the protestant work ethic of Sweat Equity get replaced by the Blood Equity of the leveraged buy-out? No value is created, other people's money is used to buy companies and the resulting profits are gained by corporate dismemberment, divestiture, and downsizing. This is the premise a new book by Josh Kosman, a veteran financial reporter and the author of The Buyout of America, How Private Equity is Destroying Jobs and Killing the American Economy. There is no point in turning this into a debate about the function of private equity given that it is now a phenomena that is well integrated into the warp and weft of the financial landscape in America. However, it is always wise to explore the career possibilities this portends for professionals and executives. What are the opportunities? Start-ups What are the employment opportunities that present themselves? Well, for starters, private equity firms have become very involved in start-up investments. Start-ups have always been the domain of the Venture Capital firms. But they have been hard-pressed to fund new ventures in the past several years. They lost investors initially after the crash and then they have been preoccupied with keeping their current farm of companies afloat. Private equity offers an alternative funding source for budding entrepreneurs for long-term funding. "Sticking to the plan you have just because you have a plan is a recipe for being really, really wrong. We have to respond to changes in the world around us. The problem now is that we don't yet know what the changes are. ", said Peter Cappelli , the George W. Taylor Professor of Management and director of the Center for Human Resources at The Wharton School.

Of course, Dr Capelli was referring to what human resource executives should do for the executives to whom they report. However, the same goes for the rest of us in determining the next steps to manage our careers. Should you stay or should you go? Would a lateral move be preferable to a move up. Is it the right time to switch to a business/industry sector with different products/services. Is a move to growing global region worth the opportunity cost? Contracting/consulting vs being an employee. These core career decisions are questions my clients face daily. Often they are not directly articulated but disguised within issues, problems and circumstances such as a company reorganization, job/product obsolescence, industry commoditization, Spain's (for example) crashing economy, income short-falls, life balance and unfulfilled ambitions. Like Cappelli, I suggest a situational approach based on potential outcomes or scenarios. It used to be said that every professional should have a plan A, B, and C for their job moves and career choices. If it were so simple now but it isn't. There are many decision-making techniques to call upon. Relying on denial, blind faith and gut feelings, albeit of unique value, are not among them. I refer you to Robert Harris's website, Virtual Salt, where he offers a myriad of tools to help you figure out stuff. You risk your future and, perhaps, company's success if you don't endeavor to parse out scenarios and outcomes for all your options. At least you will have improved and refined your responses to the unknowns that descend upon you. To deal with the unknown unknowns, I like a matrix approach with two or three columns of potential unknowns and two or three rows of options currently considered (see below). You get the idea. This gives you a chance to play out each choice against the backdrop of an unknown, in this case the economy. Try with your own scenario and tell me what you think. Does this give you more clarity? Are you at least better prepared to make the necessary choices when they come up? Your feedback is welcome. just fill in a comment. More and more frequently, companies are hiring a significant number of employees on contract at all levels. At the executive level they are referred to as interim CEOs, CFO, etc. If the professional has found the position themselves, then the title is Consultant or through a broker, then Contractor. It still all boils down to what kind of tax from is filed: a 1099 or W4.

Regardless of title or tax status, the crucial dimensions of the engagement seem to be the leveraging of "just-in-time" talent for the duration of the need. This certainly keeps an organization lean and mean and hopefully competitive. In this age of information, the downside is that the company's intellectual property walks out the door in event of a workforce retrenching. Like Wall Street quarterly numbers, there is a short-term advantage, in this case cost savings, but a long-term loss to the corporate infrastructure. Apple, for example, at $400 a share is hiring with a 60-40 rule: 60% contractors and 40% regular employees with benefits, stock options, and 401K matching. Those 60% have no loyalty and great motivation to leverage their time and accrued cache at Apple to find a higher paying position elsewhere. Say goodbye to the intellectual horsepower and gleaned expertise as it walks out the door. Google does the same thing and even houses many contract employees in different buildings where they are easy to terminate contracts and make go away without any disruption of "the force, Luke". Many people in non-essential functions are hired this way: HR/finance/accounting/marketing/sales/recruiting functions. I have singled out these companies as they are high profile, easy to use as examples and I am in their hood so I have access to information. I am sure that other companies and industries elsewhere in the USA are behaving the same way. We aren't in that flat of an economy, viable talent that can get contract work is marketable and in demand in many industries and services that have stabilized and recommenced growing. The 14M folks unemployed do not all fit that category because of obsolete skills or no work experience, age discrimination, geographical region, a consolidating industry, or too long a tenure at one company. That is the topic of another blog post in how to remedy those road-blocks. The point is that companies are being incredibly short-sighted using a just-in-time talent pool due to the loss of productivity, a reliable knowledge-base, and eventual diminishing of bottom-line results. Further, this approach, combined with a lack of a viable national safety-net of health insurance and unemployment insurance for a contract workforce will ultimately drag down an economy and a nation built on an ever-growing pile of short-term solutions to systemic unbalances and unfairness. The new tech bubble: Irrational exuberance has returned to the internet world.

May 12th 2011 | from the print edition, Economist Some time after the dotcom boom turned into a spectacular bust in 2000, bumper stickers began appearing in Silicon Valley imploring: “Please God, just one more bubble.” That wish has now been granted. Compared with the rest of America, Silicon Valley feels like a boomtown. Corporate chefs are in demand again, office rents are soaring and the pay being offered to talented folk in fashionable fields like data science is reaching Hollywood levels. And no wonder, given the prices now being put on web companies. Read the full article in the Economist Far be it for me to take issue with the Economist as the article was mostly accurate in terms of facts delivered. I live here and went through the first so-called "bubble". Without rehashing the gory details of the first bubble, let me just point out that all the derisive, mockers of online pet store, grocery delivery, and auto sales need only look at Amazon.com, Safeway.com and Cars.com. I buy pet supplies, hair products, lawn furniture and massages online now. The Economist's focus in on shareholder and investor's ROI. They miss the far broader view. That there was an economic collapse in 2000-2001 in the tech sector is not disputed but how much of it was caused, egged on and goaded by Wall Street greed and the Fed policies that, by the way, enabled this last crash as well. Were those tech companies too soon to IPO? Yes. Were they overvalued by Goldman Sachs. Definitely. Are the dot.com companies to blame. Not even for 40% of what happened. Did Silicon Valley suffer for it, yes? But, Wall Street didn't in that giant IPO ponzi scheme unless you were one of the last ones in or didn't sell soon enough. Over 400,000 jobs were lost here and less than half have been recouped. In addition, 3000+ companies went under (source linksv.com). What was lost? Talent, jobs, productivity, new products and markets but not the will to keep on growing businesses out of nothing but an idea. What's different this time? Linkedin, Groupon, Facebook are all profitable. Linkedin's share price at $45 was in line with its profits and growth rate. Is Wall Street's cultivation of it's institutional investors and the day traders antics to run the stock price up 100%, based on pure greed? Yes. Is that Linkedin's fault? No. Will Linkedin's share price be back down to the original offering level? Yes, because that's where it logically belongs. Is there a bubble? On Wall Street, in Private Equity companies, and with the new Angel investors, yes, but not in Silicon Valley. Company leaders are taking their time to bring companies public or do an M&A. Linkedin was founded in 2003 or end of 2002. It just went public after 8+ years not 8 months. Here people are working hard to make a living and a profit building new products and services using and creating new technologies. What does this have to do with the rest of the economy and the world? Silicon Valley has replicated itself worldwide. There is job creation here based on bio-tech, nano-tech, clean-tech, software, Internet, alternative energy technologies, and consumer electronics. This is not going away but rather it is growing and expanding. Yes, it's nice to have it shovel ready but tomorrow bandwidth rules economic structures not more car lanes. The true story is that job creation, and business opportunities can be replicated world-wide and it is happening. The Economist just doesn't have the full perspective nor does it understand the ramifications beyond the point of view of the investment community. Word of advice? Don't buy the stock, rather, look for the job and business opportunities. Build a Groupon leveraged business like all those little E-Bay businesses. Uncover ways to make money for yourself not Wall Street and welcome this new boom for all it's worth. In discussions at the World Economic Forum at Davos, Switzerland, the economic recovery was described by the acronym LUV as the various shapes of the look of the recovery.

In certain developed countries such as Ireland, Greece and Spain it is an L, while the USA and other EU countries is a U, and the developing nations such as China and India have a V recovery. The same analogy can be made for the recovery of the job market worldwide and specifically in the USA. It is situational depending on the local and regional industries as well as the impact of the housing market on the local economy. Without going into lengthy examples to prove the point as that can be found on government websites. Suffice to say the difference between 11% unemployment in the San Francisco Bay Area vs 7% in Salt Lake City. I can predict which labor market has the greater stability and potential for growth. Regardless of the technology growth engine in the SF Bay, that alone simply cannot create enough jobs to cover the numbers needed for full employment. The world job market echoes the same statistics. Opportunities abound in China, India, Brazil compared to the struggling EU and Eastern Europe. What is the answer? This may sound simplistic and contrived but I suggest anymore with the where with all to move. Yes, just pick up stakes and move on to new opportunities, to a cheaper standard of living, or both. Certainly that is more difficult for older workers. However, since our next generation of professionals is at the greatest risk of lack of choices and growth, they can take advantage of their ability to be mobile. I have found newer immigrants and minorities have fewer embedded ties and roots to places compared to the decendents of earlier settling populations in the USA. Regardless, opportunities will go to those who are mobile, adaptable and |

Categories

All

Archives

May 2019

Licensed by CC-by-SA

|